🔥 This offer expires in:

🔥 This offer expires in:

+1 845-335-8830

+1 845-335-8830

[email protected]

Enter The Cash Flow

The Paycheck-to-Paycheck Escape Plan: 35 Practical Solutions to Reduce Expenses, Build Savings, and Achieve Financial Freedom

Without betting it all on the next big crypto coin, ever needing to talk to a sleazy financial advisor who makes your skin crawl or studying the markets.

The Paycheck-to-Paycheck Escape Plan is your comprehensive roadmap to generating consistent returns, no matter what the markets are doing.

4.8 / 5 based on 1,931 reviews

JOHN HARRIS

COACH & DAD OF 3

I was utterly lost before simply keeping money in bank, odd investment app and paying hidden fees left right and center. I had no idea how the 'systems' truly worked but now it seems so obvious. Getting this full guide was a game changer and I saved the cost of it in one decision, plus now kick started my self education journey so I'm the one in control.

INTRODUCING

The Paycheck-to-Paycheck Escape Plan

64% of People Live Paycheck to Paycheck – Break Free Starting Today

Is Your Paycheck Working Hard Enough for You?

Every month, millions of hard-working individuals deposit their income, pay their bills, and find themselves right back where they started—waiting for the next paycheck. This cycle feels endless, but it doesn't have to be.

The truth is, te paycheck-to-paycheck trap isn't about how much you earn—it's about how you manage what you have. With rising living costs and stagnant wages, simply working harder isn’t the answer.

This guide introduces proven strategies to break free from the cycle. Discover how small, consistent changes can unlock financial breathing room, create lasting stability, and help you grow wealth—without needing a second job or extreme budgeting tactics.

Stop surviving and start thriving. It’s time to take control, plan your escape, and build a future where your money works for you—not the other way around.

Avoid a 3% Annual Erosion

Inflation averages around 3% each year, which eats away at savings when returns don’t keep up. This guide reveals strategies that consistently outpace inflation, so you keep what you earn instead of watching it lose value year after year.

Same Access As The Top 1%

Top investors don’t rely on bank accounts. This guide opens up similar opportunities, showing you ways to access high-yield investments typically reserved for the wealthiest 1%, so you can grow wealth like they do without millions to invest.

Banks Lend 5-10X Your Value

You know that number on your bank account screen? Well banks lend 5-10X more than that, making high interest rates as they go and giving you back a pathetic sub 1%. We'll show you how to make your money work for you, not them.

Invest In Under 5 Minutes A Week

Moving away from banks into investment opportunities isn't complicated or scary. even though they will try to make it that way (I wonder why...) - we'll show you how to do that in under 5 minutes per week without the complexity.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your purchase, you'll receive all the links to download all 8 of our courses and in just a few clicks!

A Step-by-Step System to Escape the Paycheck Trap and Build Long-Term Wealth

Here's the course content:

Part 1: Break Free from the Cycle – Start Your Financial Escape Plan (26 min)

Discover the simple, proven steps to break free from living paycheck to paycheck. Learn how to optimize your income, track your expenses, and build a savings plan that works—even if you've struggled with money management before.

Part 2: Grow Your Money – Build Multiple Streams of Income (40 min)

Explore practical ways to grow your income beyond your 9–5. From high-impact side hustles to smart, beginner-friendly investments, this section helps you unlock new opportunities to grow wealth without working endless hours.

Part 3: Scale Your Wealth – Automate, Invest, and Secure Your Future (24 min)

Learn how to scale your financial growth with automated savings, simple investment strategies, and passive income streams. Discover how tools like the

Paycheck Freedom Budgeting Template

can simplify wealth tracking—so your money works while you sleep.

How to Take Control of Your Finances and Escape the Paycheck Trap

Here's the course content:

Part 1: Laying the Foundation – What You Need to Know Before Taking Action (11 min)

Discover the critical financial insights that most people overlook. From understanding your money habits to identifying invisible wealth drains, this section gives you the research-backed knowledge to make smarter financial decisions.

Part 2: Building Your Escape Plan – Step-by-Step Strategies to Stop Living Paycheck to Paycheck (34 min)

Learn how to create a personalized plan that prioritizes savings, reduces debt, and opens the door to new income streams. With the

Paycheck Freedom Budgeting Template

as your guide, you’ll see exactly how to structure your money for long-term success.

The Paycheck Freedom Formula: Your Path to Lasting Financial Independence

Here's the course content:

Part 1: How to Increase Your Financial Value (and Your Income) (44 min)

Discover how to boost your financial potential by developing key skills, shifting your money mindset, and strategically increasing your income. Learn why financial success isn’t about working harder—it’s about understanding how money really works.

Part 2: How to Build Multiple Streams of Income for Financial Freedom(36 min)

Learn how to create and grow income streams beyond your paycheck. From side hustles to passion-based businesses, this section guides you through simple steps to become the CEO of your financial life.

Part 3: How to Make Your Money Work for You – The Essentials of Investing (50 min)

Master the basics of investing in stocks, real estate, and businesses—even if you’ve never invested before. With the

Paycheck Freedom Budgeting Template

as your guide, you’ll track your investments, monitor growth, and watch your wealth build over time.

Launch Your Financial Escape Plan: Break Free from the Paycheck Trap in Record Time

Here's the course content:

Intro:The step-by-step method to break free from the paycheck-to-paycheck cycle in just 7 days—and build wealth for years to come.

(14 min)

Part 1: How to Build a Financial Escape Plan That Works(44 min)

Learn how to create a customized plan to escape the paycheck cycle. Discover the core money principles that fuel financial freedom, and use the

Paycheck Freedom Budgeting Template

to build a simple, actionable system that fits your life.

Part 2: How to Execute Your Plan, Take Control, and Make Your First Big Financial Wins(28 min)

Follow a proven, step-by-step process to launch your escape plan, make your first smart money moves, and experience the momentum of financial growth. With the 12-Month Financial Escape Plan

as your guide, you’ll stay on track and build confidence with each milestone.

Side Hustle Success: How to Start Earning Extra Income with Minimal Time

Here's the course content:

Part 1: How to Earn $2,000/Month with Just 1 Hour of Work per Week(25 min)

Discover simple, low-effort side hustle strategies that can generate thousands of dollars per month—without quitting your job or sacrificing family time. These methods are designed to fit into any schedule and help you escape the paycheck trap faster.

Part 2: How to Make Sales (Even If You’ve Never Sold Anything Before)(36 min)

Learn straightforward, no-pressure techniques to promote your side hustle and attract customers without feeling like a salesperson. From word-of-mouth strategies to social media hacks, you’ll gain confidence in turning ideas into income.

Part 3: How to Deliver Value, Help Others, and Grow Your Income Over Time(27 min)

Discover how to serve your customers, build trust, and turn one-time buyers into loyal supporters. By providing genuine value, you'll create a sustainable income stream that grows month after month—all while working minimal hours.

How to Make Your First $1,000 Beyond Your Paycheck

Here's the course content:

Part 1: The Classic Method – Simple Steps to Earn Your First $1,000 (11 min)

Discover tried-and-true strategies to make your first $1,000 by leveraging skills and resources you already have. From selling unwanted items to offering simple services, this classic approach is a reliable first step to building financial momentum.

Part 2: The New, Faster Method – Using Consulting to Boost Your Income (19 min)

Learn how to turn your knowledge and experiences into a profitable consulting gig. Whether it’s personal finance, fitness, or marketing, this faster method helps you start earning without a large investment.

Part 3: The Easy Method – Launching an Affiliate Income Stream(11 min)

Explore how to earn commissions by recommending products and services you love. This beginner-friendly business model requires minimal setup and can be done alongside your regular job—making it one of the easiest ways to start earning extra income online.

SETUP YOUR ONLINE BUSINESS TODAY WITH OUR $14,698 VALUE PLR BUNDLE FOR JUST $97!

4.8 / 5 based on 1,931 reviews

Exclusive Bonuses Just For YOU!

Along with the Course, get special bonuses that turbocharge your online success. These extras are designed to complement your learning and give you an edge in the digital marketplace. Act now to unlock these invaluable tools!

BONUS 1: Top 8 Investment Tools Used by the Top 1%

Discover the same powerful tools that wealthy investors rely on to grow and protect their wealth.

BONUS 2: 25 Books the Banks Don’t Want You to Read

A curated list of eye-opening books that reveal financial secrets and strategies to take control of your money)

BONUS 3: Excel Investment Tracking Template

Simplify your investment tracking with a pre-designed Excel template, making it easy to monitor growth, returns, and asset allocation.

BONUS 4: 12-Month Wealth-Building Checklist

Stay on track with a month-by-month action plan, guiding you through your financial transformation over the next year.

BONUS 5: 8 Passive Income Ideas in Under 10 Minutes a Day

Kickstart extra income with these quick and easy passive income ideas that fit into any schedule.

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

TERA LEWIS

Small Business Owner

"I always thought I was being smart—saving money, paying down debts... but this guide blew my mind. Turns out, there’s way more I could be doing to actually grow what I have. It’s crazy. I’m making moves now that I didn’t even know were possible. Already seeing the benefits, and it’s been worth every cent."

Verified Review

JONATHAN CHEN

Engineer & Investor

"Always wanted to take charge of my finances but felt like it was just... too much info out there, you know? This guide just lays it all out, step by step. Now my money’s actually working FOR me instead of just sitting in a bank. One month in, I’m already seeing more growth than years of just ‘saving’ ever did."

Verified Review

SUSAN COLLINS

Freelancer & mom of 2

"Bank fees, low interest rates... basically, my money was just stagnant. I didn’t even realize how much of a trap I was in till I read this. Just one of the decisions I’ve made from this guide saved me what it cost, honestly. It’s like I finally got control over my own money. Total game-changer."

Verified Review

SAM JOHNSON

Self-employed entrepreneur

"I used to feel, well... totally clueless about investing and where to start. Then I got this guide, and boom—direction. It’s like having a road map for my money. My biggest regret? Not getting this sooner. Seriously, if you’re looking to break out of that paycheck-to-paycheck cycle, this is it."

Verified Review

JASMINE HASAN

College student & part-time worker

"People always say, ‘Just save your money!’ but no one ever tells you HOW to actually make it grow. This guide changed that. I’m starting small but even now I can see the difference it’s making. For the first time, I’m actually excited about my finances!"

Verified Review

JUAN GONZALEZ

Marketing professional

"I’ve been stuck in the traditional banking loop for years, just assuming it was safe and smart. Wrong. This guide opened my eyes. I’m now actually seeing my money do something other than sit there gathering dust. If you’re on the fence, get off it and grab this. It’s already paid for itself, trust me."

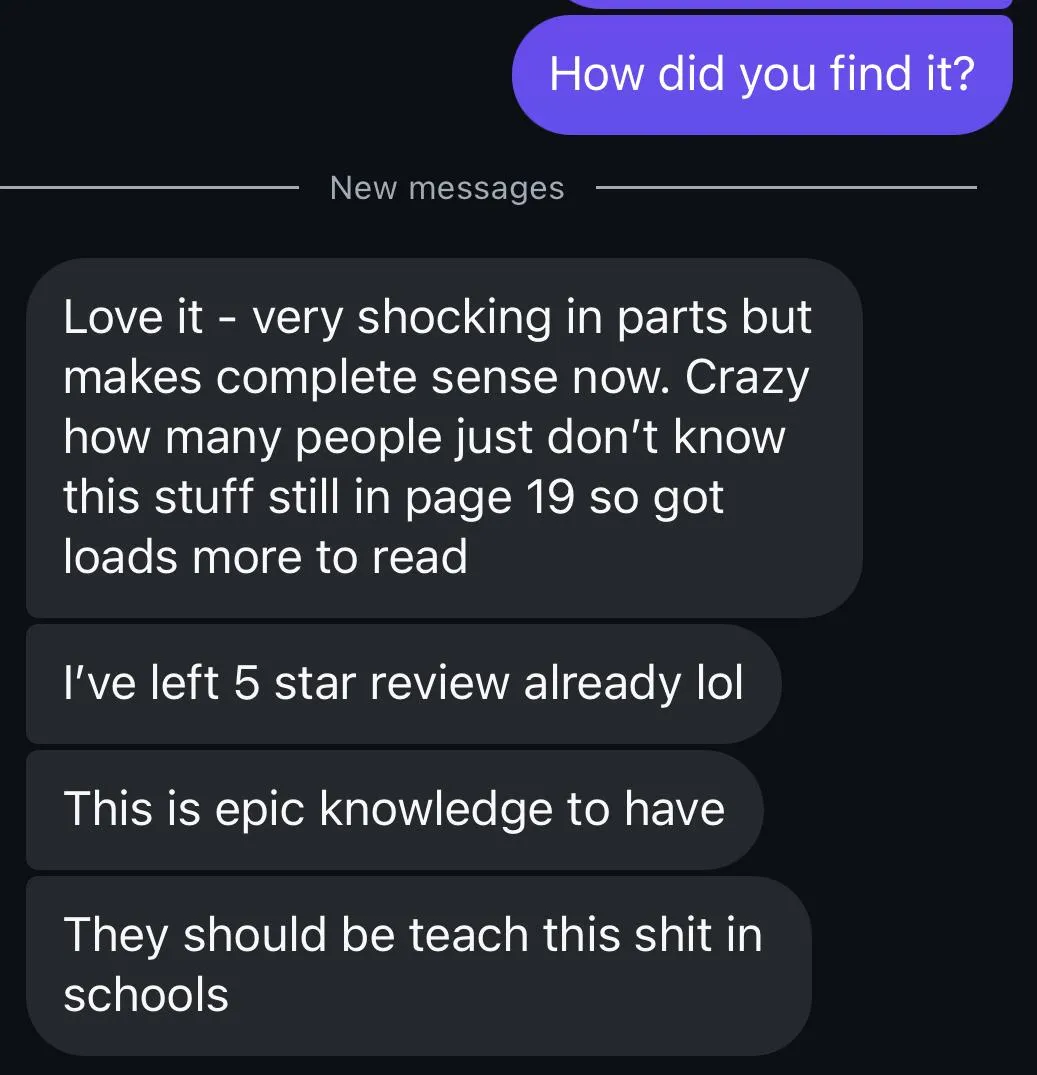

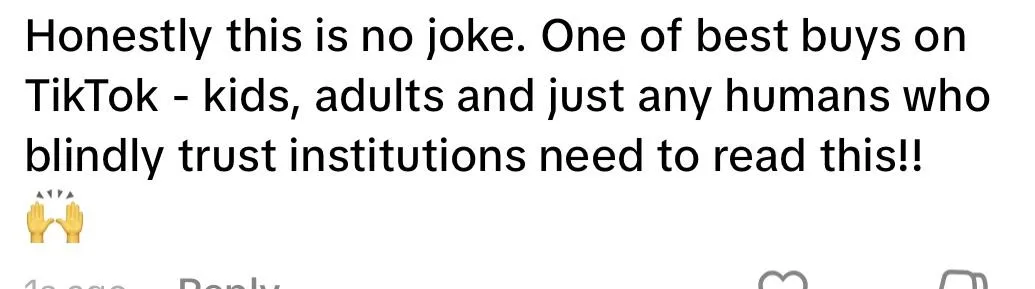

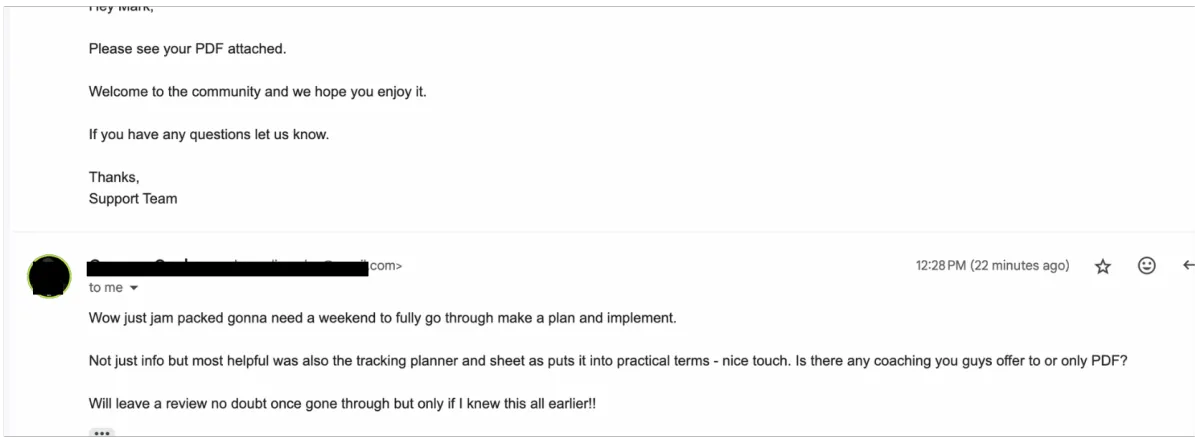

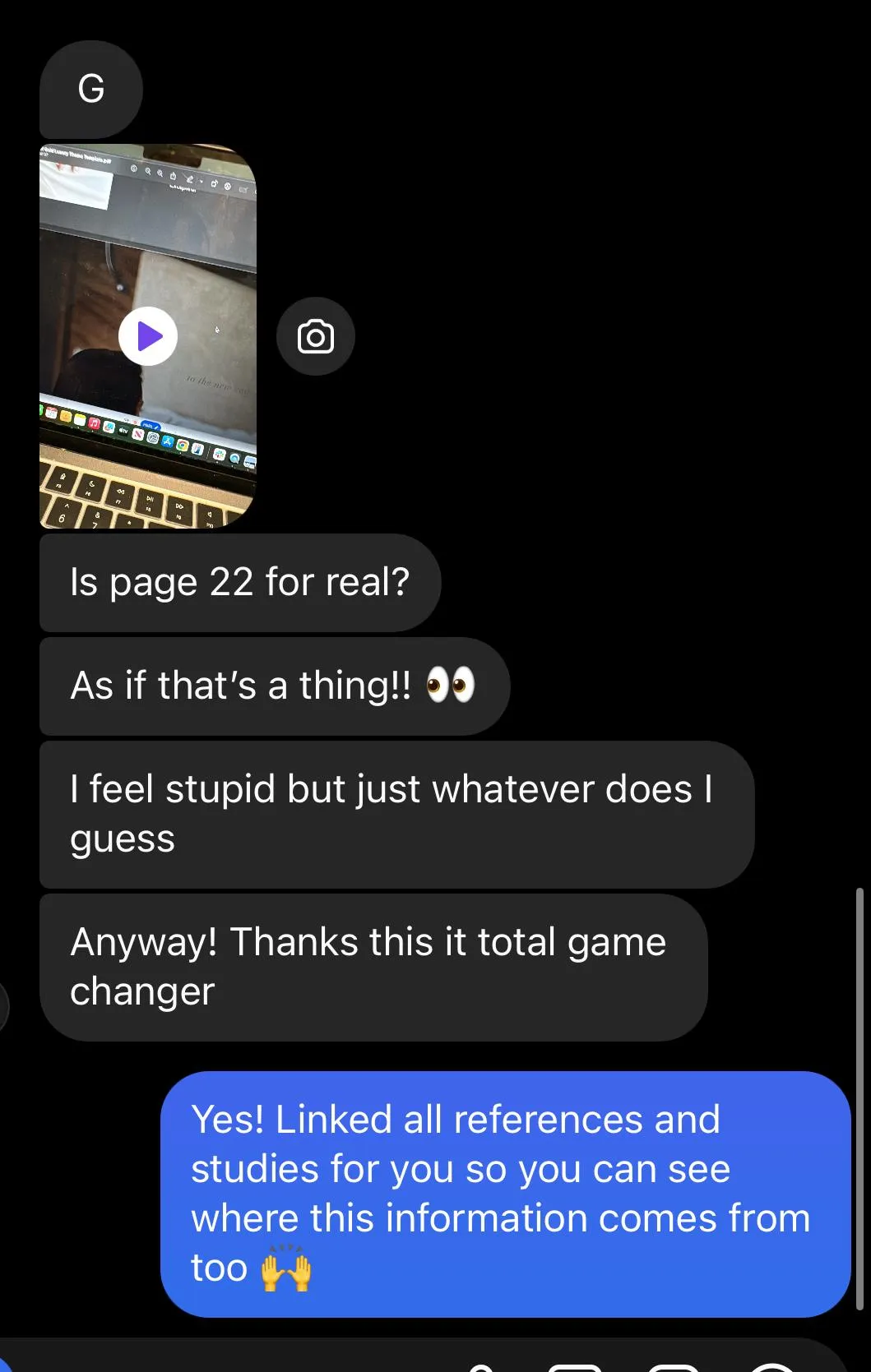

Want More? People Just Like You Send Us In This Everyday...

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get The Paycheck-to-Paycheck Escape Plan PDF Today!

With the bundle, you gain immediate access to invaluable resources on how to beat the banks and take control of your financial future. For a limited time, grab this comprehensive package at an unbeatable price. Don’t miss this chance to transform your future and join the top 1%.

Paycheck-to-Paycheck Escape Plan PDF

$17 USD

VAT/Tax Include

4.8 / 5 based on 1,911 reviews

Full 43 Page Paycheck-to-Paycheck Escape Plan PDF

BONUS 1: 8 Smart Money Moves the Top 1% Use to Escape the Paycheck Cycle

Discover the financial habits and strategies that wealthy individuals use to break free from paycheck dependency—and how you can apply them to your own life.

BONUS 2: 25 Books That Can Help You Escape the Paycheck Trap

A handpicked list of must-read books that reveal the hidden rules of money, budgeting, and wealth-building that most people never learn.

BONUS 3: Paycheck Freedom Budgeting Template (Excel)

Take control of your cash flow with an easy-to-use template designed to track your income, expenses, savings, and financial goals—without the headache.

BONUS 4: 12-Month Financial Escape Plan

Follow a simple, step-by-step checklist to go from paycheck-dependent to financially confident in just one year.

BONUS 5: 8 Easy Side Hustles You Can Start in 10 Minutes a Day

Learn about quick-start side hustles that fit any schedule—so you can grow extra income without burning out.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide walks you through why traditional banking may be holding you back financially and introduces proven strategies the wealthy use to grow their wealth. You’ll learn step-by-step how to make smarter financial decisions, set up passive income streams, and protect your money from losing value over time.

Is this guide suitable for beginners?

Absolutely. We’ve designed it for anyone who wants to take control of their finances, whether you’re a complete beginner or have some investment experience. The guide explains everything in clear, simple terms with actionable steps anyone can follow.

Do I need a large amount of money to start?

Not at all! Many of the strategies we share are suitable for any budget. You’ll learn techniques that you can start with a small amount of money and grow over time.

How quickly can I see results?

Some changes, like avoiding hidden banking fees, can bring instant savings, while other wealth-building strategies work over time. With consistent action, you’ll likely see noticeable improvements within the first few months.

Will this guide work for me if I’m already investing?

Yes, definitely. This guide provides insights into strategies used by the top 1% and goes beyond basic investing. You’ll learn methods to enhance your current strategy and uncover areas where you might be losing money without realizing it.

What resources come with the guide?

Along with the main guide, you’ll get a 12-month wealth-building checklist, an Excel investment tracking template, a list of top tools, book recommendations, and easy passive income ideas—all designed to support you in taking action.

How is this different from free advice I can find online?

Great question! This guide brings everything together in one place, with actionable steps and insider strategies that are often scattered across multiple sources. We’ve condensed years of financial wisdom into a single, easy-to-follow guide to save you time and effort.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you save and grow your money—many users report getting more than their money’s worth within days of implementing the tips.

4.8 / 5 based on 1,931 reviews

All rights reserved Enter The Cash Flow

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.